As an investor, you must evaluate the company before making a decision on whether to invest in it or not. This evaluation would help you take trades with most potential for profit and least probability of risk. Such evaluation is carried out through Fundamental Analysis. Fundamental Analysis involves evaluating the company’s financial status by studying its Balance Sheet, Income Statement (also called Profit and Loss Statement), Cash Flow Statement, and its Financial Ratios. Out of these, Financial Ratios help us compare two or more financial parameters of the company to understand its financial status better. Using these ratios, you can understand the company’s financial health and also compare the company to its peers that operate in the same industry or sector. One such parameter is Debt to Equity Ratio. In this blog, we will find out more about Debt to Equity Ratio and the debt to equity ratio formula.

Debt and Equity

In order to understand this ratio, we first need to understand the definition of each term. Every company raises capital in two ways, namely, Debt financing and Equity Financing.

Debt Financing is essentially borrowing money from a creditor by taking a loan at a fixed interest rate. Equity financing refers to issuing of equity shares of the company to the general public (through IPOs and FPOs). Equity financing is more expensive, dilutes earnings per share of existing shareholders, and is a time consuming process.

Debt financing involves only interest payments as the primary cost. This can be deducted from their overall tax liability and thus makes it the preferred form of financing. However, Debt financing comes with Credit Risk. In the scenario where the borrower fails to repay the principal or interest amount, investors (creditors) are left with no choice but to declare it as a non-performing asset.

Debt to Equity Ratio Formula and How to Interpret It

Now, let us understand what is Debt to Equity Ratio and how it is calculated.

As the name suggests, this financial ratio calculates the company’s total debt versus the equity. Calculating and evaluating the Debt to Equity Ratio tells investors how much of the company’s assets are debt financed. This would aid them in measuring credit risk in case the company is liquidated.

Debt to Equity Ratio is also known as Gearing Ratio or Risk Ratio. It comes under Leverage Ratios or Solvency Ratios. These ratios help analysts compare the debt level of a company to its equity and assets. This allows them to understand the company’s ability to meet its long term debt obligations.

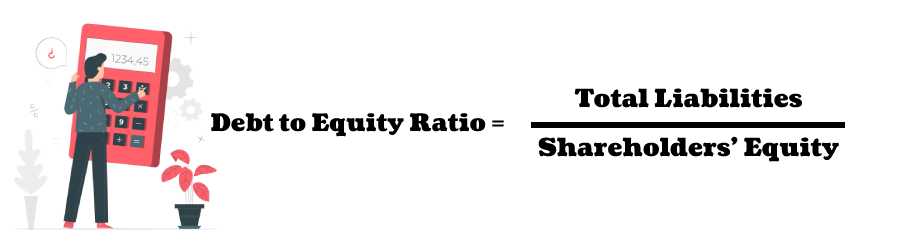

Debt to Equity ratio is calculated by dividing total liabilities of the company by its shareholders’ equity.

Where, Total Liabilities refers to long-term debt with a minimum maturity period of more than five years. It is a non-current liability and is not the same as short-term debt which must be repaid within five years.

Quick Ratio or Current Ratio would be better suited to understand the company’s ability to repay its short-term debts or liabilities.

As Debt to Equity Ratio calculates whether the company can repay its long-term debt, we can deduce that a high value for this ratio would not be a favourable sign. A high debt to equity ratio would signify that the company does not have enough equity to repay its debts and thus makes it a high-risk investment. This is because if a company goes bankrupt, on liquidation, it is first obligated to pay off its debt liabilities before it can pay back any investments made by equity shareholders.

A company with a Debt to Equity Ratio of 1:1 is considered to be safer as the company has equal amount of debt and equity. Whereas, a company with a debt to equity ratio of 2 or more is considered to be a risky investment since the company owes twice the amount of debt as compared to its equity.

Ideal Debt to Equity Ratio

When evaluating a company, we must consider its financial ratios and also compare them to the other companies operating in the same sector or industry. Knowing the ideal debt to equity ratio for a company aids us in assessing the company correctly.

Some companies may have negative debt to equity ratios. It signifies that the company pays high interest on its debt obligations and earns low return on equity. Or it may indicate that the company has negative networth. For example, SpiceJet has a debt to equity ratio of -0.25.

Some companies have a low or zero debt to equity ratio. Generally, these are considered safer investments but it may also indicate that the company is not taking advantage of financial leverage for increasing its profits. It may not be utilizing the opportunity to expand its business and increase its profits by taking debt. At times, the company could have low debt to equity ratio but not perform well in other aspects, making it a bad investment.

However, assuming that a company is a bad investment based only on its high debt to equity ratio is also incorrect. Some industries are capital intensive and thus have high Debt to Equity Ratios. Companies operating in the automobile, power, utilities, and financial sector typically have high debt to equity ratio while also being good avenues for investment. This makes it necessary to consider the average debt to equity ratio of the industry before making a decision.

The interest Coverage Ratio is an important financial parameter that can help us make the final decision in case of companies having a high debt to equity ratio. This ratio tells us about the company’s ability to pay the interest due on their liabilities. High Interest Coverage Ratio, above 1.5 is considered to be a good sign for creditors. An interest coverage ratio of less than 1.5 indicates that the company may default on its interest payments and are not good investments.

Implications of High Debt to Equity Ratio

A high debt to equity ratio indicates several factors about the company. We shall discuss them in this segment.

Reduction in Equity Ownership: A high debt to equity ratio signifies that shareholders’ equity is less and thus they have lower claim on the company’s earnings and assets as compared to the lenders and creditors. This also means that a large portion of the earnings is used for debt servicing, reducing the earnings per share for the shareholders.

Increase in Credit Risk: As mentioned above, debt financing comes with credit risk. When the debt equity ratio is high, the company has to spend more money to make repayments of debt and this might lead to the company declaring bankruptcy. In this scenario, equity shareholders may lose their entire investment. The money from liquidating the company and its assets will be utilized in repaying its liabilities.

Difficulty in securing additional debt: In case a company wants to expand its existing business or start a new project, it will try to seek funds from lenders. If it already has a high debt to equity ratio, lenders may hesitate to provide the company with more funds as there will be a risk of the company defaulting its loan repayment.

Limitations of Debt to Equity Ratio

The most common mistake made by investors when considering the debt to equity ratio of the company is not checking the industry standard. As different industries have different capital requirements and different time frames for growth, a debt to equity ratio levels for each industry are different. To rectify this error, we must compare the ratio with the level for the rest of the companies operating in the same industry.

Furthermore, while Debt to Equity Ratio is a good parameter to assess the financial health of the company, we must also remember to check other financial ratios of the company before making our investment decisions. At the very least, an investor must check whether the company has a good return on equity before investing.

We hope this blog has clarified Debt to Equity Ratio and how to interpret it.

FAQs

Q. What are the instruments for Debt Financing?

Answer: Secured Loans, Term Loans, Debentures, Non-Convertible Debentures, Zero Coupon Bonds, Corporate Bonds, External Commercial Borrowings (foreign currency loans), fixed deposits (if security is provided), Funded interest term loan (FITL), and Working capital term loan are the instruments used for Long Term Debt Financing. Unsecured Loans and Working Capital loans are not considered for calculating Long Term Liabilities for Debt to Equity Ratio.

Q. Which industry has one of the lowest Debt to Equity Ratio?

Answer: Services industry has the lowest debt to equity ratio as they have very few assets to leverage.

Our Latest Blog –

Follow us – Linkedin